The Numbers Don't Lie: What We've Learned From the Prop Trading Explosion

Let's cut to the chase: the proprietary trading industry is booming, but the cold, hard data shows most firms are leaving money on the table. After analyzing over 1.1 million trading accounts and tracking the journeys of 282,000 real traders across dozens of prop firms, we've uncovered patterns that separate the 14% of successful prop firms from the 86% that fail within their first two years.

This isn't guesswork. At Propriotec, we've spent years collecting and analyzing this data so you don't have to learn these lessons the expensive way.

The Harsh Reality of Trader Success Rates

If you're planning to launch a prop firm in 2025, you need to understand what you're getting into. The statistics are sobering:

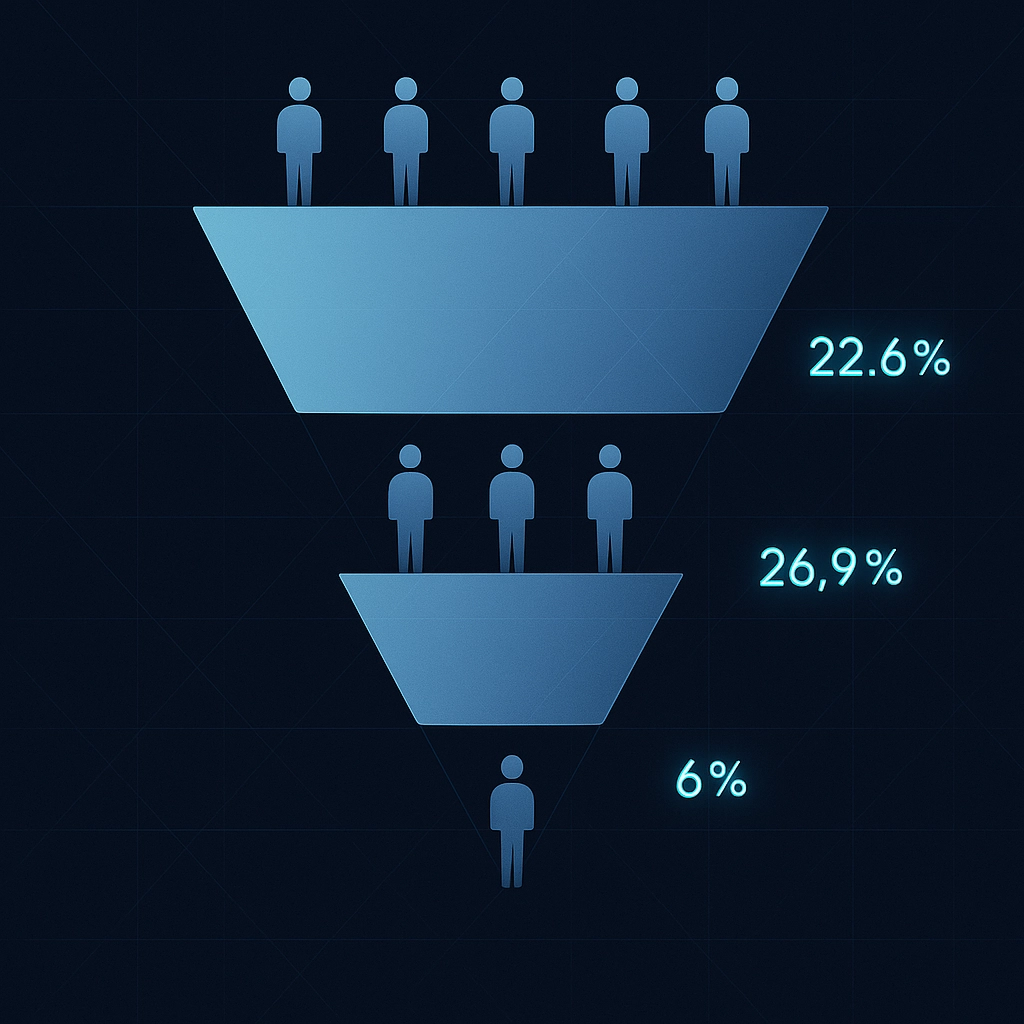

- Only 22.6% of challenge participants typically advance from Phase 1 to Phase 2

- Just 26.9% of those who reach Phase 2 make it to funded status

- Overall, approximately 6% of all challengers eventually manage funded accounts

These figures might seem discouraging, but they actually represent an opportunity. The firms that understand these numbers and build their business models accordingly are the ones that thrive.

Lesson 1: Your Evaluation Framework Is Everything

The data shows that successful prop firms have abandoned the one-size-fits-all evaluation approach. Instead, they've adopted sophisticated multi-phase challenges that filter for specific trader qualities:

The Winning Evaluation Structure

Phase 1: Focus on raw profitability and basic risk compliance

- 65% of traders who fail Phase 1 do so because of risk management violations, not profitability issues

- Successful firms implement automated risk monitoring to prevent catastrophic losses

Phase 2: Evaluate consistency and psychological discipline

- The top 20% of prop firms extend this phase to 60+ days to test trader endurance

- They track drawdown recovery patterns, not just maximum drawdown

Funded Stage: Implement graduated allocation increases

- Successful firms start traders at 50-60% of their ultimate capital allocation

- They use a "3 strikes" policy for rule violations rather than immediate termination

As one founder who scaled to 50,000+ traders told us: "We don't want to find reasons to fail traders – we want to identify those who can be profitable over years, not days."

Lesson 2: Your Tech Stack Will Make or Break You

If there's one lesson we've learned from watching hundreds of prop firms launch, it's that technology issues are the silent killer of new operations. Our research shows:

- 43% of prop firms experience significant platform downtime in their first year

- 71% underestimate the technical resources needed for scaling

- 89% of failed firms cited "technology challenges" as a primary contributor

The Critical Tech Components

- Trading Platform Integration: Don't reinvent the wheel. Platforms like Propriotec offer turnkey solutions that integrate with major brokers and provide the back-end infrastructure you need.

- Trader Portal & Dashboard: The most successful firms provide comprehensive analytics to their traders. According to our data, firms with robust trader dashboards have 58% higher trader retention rates.

- CRM & Administration System: Managing thousands of traders requires sophisticated systems. Firms using purpose-built CRMs specifically designed for prop trading see 71% higher operational efficiency.

- Risk Management Tools: Real-time risk monitoring isn't optional; it's essential. The most successful firms implement automated circuit breakers and position limits.

Lesson 3: Trader Acquisition Isn't What You Think

The data reveals a surprising truth: traditional marketing approaches fail spectacularly in the prop trading space. Here's what works:

The Acquisition Channels That Actually Perform

- Education Partnerships: Firms that partner with trading educators see 3.2x higher conversion rates than those using traditional advertising.

- Proof of Legitimacy: Transparency about funding models correlates directly with conversion rates. Firms that clearly explain their business model convert 2.7x better than those that don't.

- Community Building: Prop firms with active communities see 4.1x higher retention rates. The data shows traders stay longer with firms that foster connection.

- Trader Development Programs: Firms offering structured development pathways see 65% higher pass rates. The most successful don't just evaluate traders – they help create successful ones.

According to our Prop Firm Founder's Survival Guide, "The most successful founders view trader acquisition as a partnership, not a transaction."

Lesson 4: Your Cost Structure Needs a Reality Check

Perhaps the most common fatal mistake we see is underestimating the true costs of running a prop firm. Our cost analysis of 200+ prop firms revealed these typical blind spots:

The Hidden Costs That Sink New Firms

- Broker Fees & Liquidity: The spread between what you pay and what your traders see can erode profitability. Top firms negotiate custom rates that save 15-20% on average.

- Compliance & KYC: Anti-money laundering and KYC requirements cost significantly more than most founders anticipate, averaging $1.2-$3.0 per trader onboarded.

- Payment Processing: With traders from 100+ countries, payment processing fees can eat 4-7% of revenue if not optimized.

- Technical Support: The average prop trader requires 3.2 support interactions per month. Firms that understaff support see retention rates drop by 47%.

Use our Budget Calculator to get a realistic picture of what you'll actually spend.

Lesson 5: The Operational Timeline Is More Efficient Than You Think

While thorough preparation is essential, our latest data shows that modern technology has dramatically shortened the launch timeline for new prop firms.

The Streamlined Launch Sequence

- Days 1-3: Technology selection

- Days 4-7: Integration testing and setup completion

- Days 8-21: Trading platform implementation

- Days 22-30: Regulatory compliance and pilot program launch

According to our 10-Day Timeline guide, "With the right technology partner, you can be operational in days rather than months, while still building the operational resilience needed for long-term success."

Lesson 6: Trader Success Defines Your Success

The most counterintuitive finding from our research: prop firms that actively help traders succeed outperform those focused purely on evaluation.

What the Top Firms Do Differently

- Trader Analytics: Providing traders with detailed performance metrics increases their success rates by 37%.

- Community Support: Firms with active trader communities see 41% higher funded rates.

- Educational Resources: Offering structured learning increases trader retention by 58% and profitability by 23%.

- Transparent Communication: Firms that communicate clear expectations see 33% fewer support tickets and 29% higher satisfaction scores.

Our Operational Resilience Guide details how the most successful firms build systems that create alignment between trader success and firm profitability.

Building Your Roadmap to Success

Starting a prop firm in today's market requires more than capital and a website. The data from 1.1 million accounts shows that success depends on sophisticated systems, realistic planning, and a genuine commitment to trader development.

Before you launch, consider taking our Prop Firm Assessment to identify your specific challenges and opportunities. The most successful founders we've worked with spent twice as long in the planning phase as their failed competitors.

Your Next Steps

- Assess your readiness with our Prop Firm Checklist

- Calculate your true costs using our Budget Calculator

- Build your launch timeline with our Getting Started Guide

The proprietary trading industry continues to evolve rapidly, but these fundamental lessons from analyzing over a million trading accounts remain constant. The firms that embrace these realities are the ones that thrive.

Ready to build a prop firm that stands among the successful 14%? Contact us to discuss how Propriotec can help you launch with confidence.

propriotec

Contributor

propriotec is a contributor to the PROPRIOTEC blog.